“Build and they will come” – Covid-19 and the Thames Valley Office Market”

Many naysayers have espoused the view in recent weeks that demand for offices in the South East has fallen off the edge of a cliff as a result of the Covid-19 pandemic and the ensuing Government lockdown and is unlikely to return for the foreseeable future. In reality, nothing could be further from the truth.

Take up in the region in the first quarter of 2020 totalled just over 540,000 sqft in line with take up in the same quarter in 2019 with major lettings to occupiers from those sectors which have historically underpinned demand in the region. Pharmaceutical giant Eli Lilly have recently leased 43,000 sqft in a new headquarters building in Bracknell, the largest letting in the town for almost a decade at the highest rent in the town for almost as many years. Telecoms company Motorola have acquired 19,700 sqft of space at Midpoint in Basingstoke whilst Xero, the accountancy software firm have acquired 56,000 sqft in Milton Keynes. PWC have signed up to 28,500 sqft in Watford whilst in Woking premium beer brewers Asahi have leased 34,500 sqft.

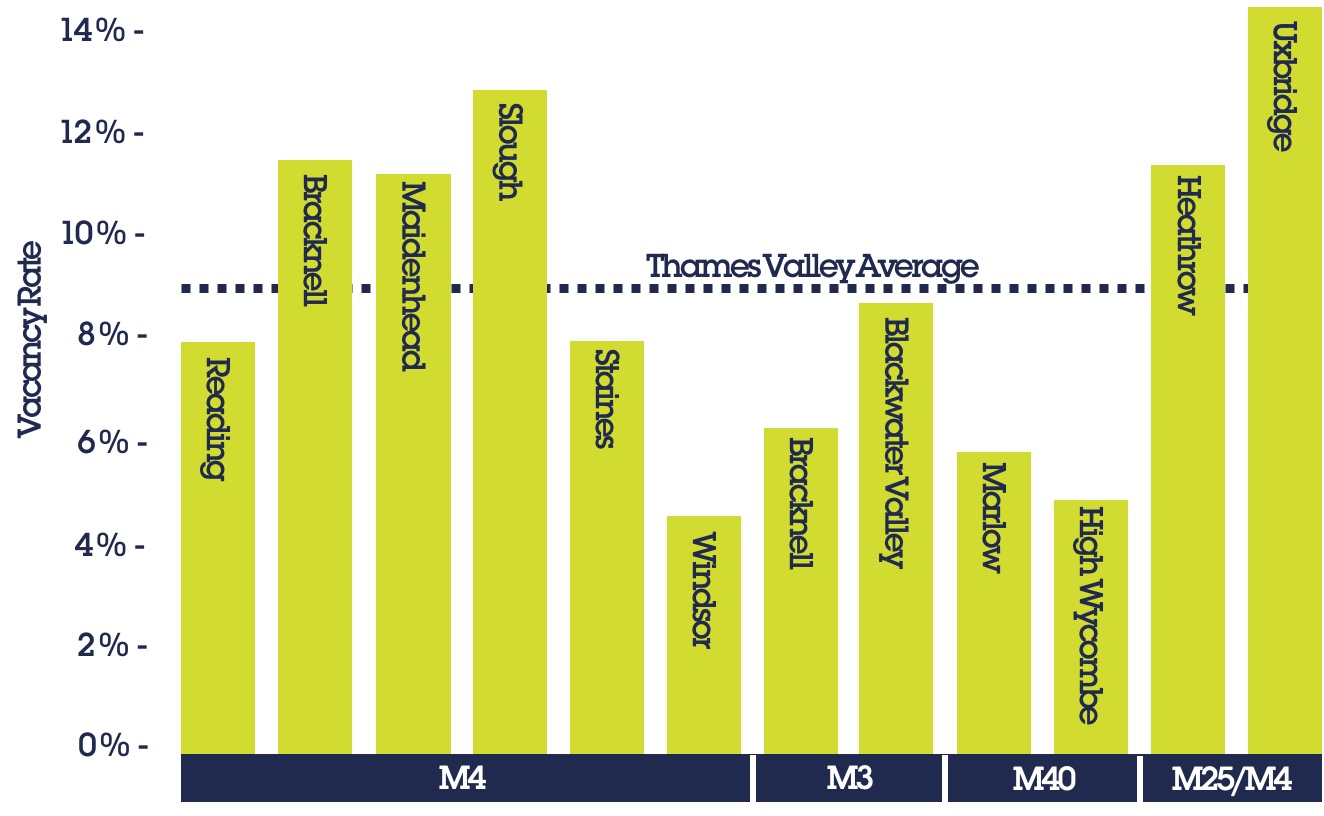

Lettings of Grade A space have dominated take up, accounting for 82% of all lettings and coincided with the lowest levels of supply at only 7.4 million sqft or 8.7% vacancy across the region, the lowest level for 15 years.

And when we all emerge from lockdown and start returning to work, how many employees will be keen to spend up to two hours a day commuting to offices in central London at great personal cost (and risk) only then to spend almost as long reaching the upper floors in some skyscraper when lifts are only permitted to carry a maximum of four people at a time? The past decade has witnessed many Thames Valley occupiers relocating to central London, but the wisdom of those decisions may now be called into question. Only last week, Barclays CEO, Jes Staley, said “the bank, which like companies worldwide has seen the majority of its staff work from home or backup sites, will not revert fully to its pre-January working habits. There will be a long-term adjustment in how we think about our location strategy…the notion of putting 7,000 people in a building may be a thing of the past,” he told reporters after the bank reported a sharp fall in first-quarter profits.

And with office overheads under increasing scrutiny, companies will be questioning how they can further cut occupational costs. The Q1 2020 RARE Seat Survey highlights just what savings can be made by relocating from central London to the region. “Half an hour and halve the cost” is a strap line coined by RARE Founder Jonathan Mannings, in relation to a scheme he was marketing in Swindon but applies equally well to the savings that can be made by a relocation from central London to the comparatively modest costs of the Thames Valley. Costs can be further defrayed by acquiring “plug and play” space on highly flexible terms, allowing the decision to be kept under constant review over the next 2-5 years as we adjust to the new normal.

RARE, have recently been instructed on a range of properties that will particularly appeal to occupiers seeking a combination of low entry costs, highly flexible leases and well-located buildings enjoying ready access to central London. In Reading, the firm have been appointed sole agents by OVO Energy to lease 27,200 sqft in One Forbury Place. The building, completed just over three years ago, offers fully fitted and cabled, plug and play workstations for 274 staff in its current configuration on highly flexible leases from 24 months to 11 years. The landmark building boasts an on-site coffee shop and restaurant and offers occupiers lower running costs from the low-cost energy generated by the photovoltaic panels located on the roof of the building. With green credentials further enhanced by electric car charging points and the fact that the building is situated only a few metres from Reading station with its over 350 daily train services to London Paddington the space makes a compelling offer for companies wishing to attract and retain the best staff whilst ensuring its running costs are as low as possible. Access to an extensive suite of meeting and conference rooms also ensures that occupiers need only commit to the space they need on a regular basis with the conference and meeting facilities being bookable on an as and when required basis. The available accommodation is offered in suites from 10,000 sqft upwards.

In Slough and only minutes from the station with its 15-minute train services to central London, RARE are also appointed leasing agents on 25 Windsor Road a landmark building in the centre of the town. However, unlike the competing options, this offers generous parking in the adjacent private, multi-storey car park. 17,123 sqft is located on the fifth floor and enjoys far reaching views over the town and surrounding countryside and yet is only 7 minutes drive from Heathrow Airport. The air-conditioned accommodation is available in suites from 6,000sqft.

In Basingstoke, RARE are offering the only two Grade A office buildings available in the town. Both Neon and Benchmark offer 45,000 sqft and 42,500 sqft respectively and are located on Basing View, one of the most exciting and amenity rich business destinations in the south east. The location is home to the largest co-located John Lewis and Waitrose stores in the UK and the recent opening of the 153-bedroom Village hotel has boosted amenity on the intown business park by offering a gym, pool and spa, coffee shop and restaurant. Both buildings are offered on a pre-let basis and can therefore still accommodate an occupier’s specific fitout requirements thereby reducing the lead in time for occupation. Their location on Basing View means they are only a few paces from the town’s station with its regular services to central London as well as over 90 other national destinations as well as to Festival Place the regional shopping and leisure destination.

Commenting on the market in the region, Jonathan Mannings, Founder of RARE said “the underlying fundamentals that have driven demand in the Thames Valley over the past 30 years remain strong; good access to central London, access to quality housing and good schools, therefore a high standard of living as well as access to a stock of quality office buildings offered at a comparatively modest cost when compared to those in central London will ensure that demand for offices in the region remains strong. It is obvious that the requirements for social distancing and fewer “surface touch” access controls will have an impact on the design of buildings in the future. But even with occupiers potentially having reduced requirements for space as they increasingly adopt homeworking as part of their overall accommodation strategy, the need for staff to meet on a regular basis in a quality environment, therefore ensuring an organisation attracts and retains the best talent will remain and we expect demand to outstrip supply in certain towns in the region over the coming months. For that reason, we would encourage developers and institutions with sites and buildings requiring refurbishment to get on and use this time when the market is moving more cautiously, to bring forwards space to meet the undoubtedly strengthening demand we are likely to witness from next year onwards. Build and they will come is a much over-used saying in the property industry but when it comes to delivering Grade A buildings in the Thames Valley, there has possibly never been a better time to get cracking.”

For further information on any of the above available buildings or to see details of other available properties currently being offered by RARE please visit: www.ra-re.co.uk. RARE:Find also offers occupiers specific help and advice in finding the ideal property solution. For further details please visit: www.rarefind.co.uk