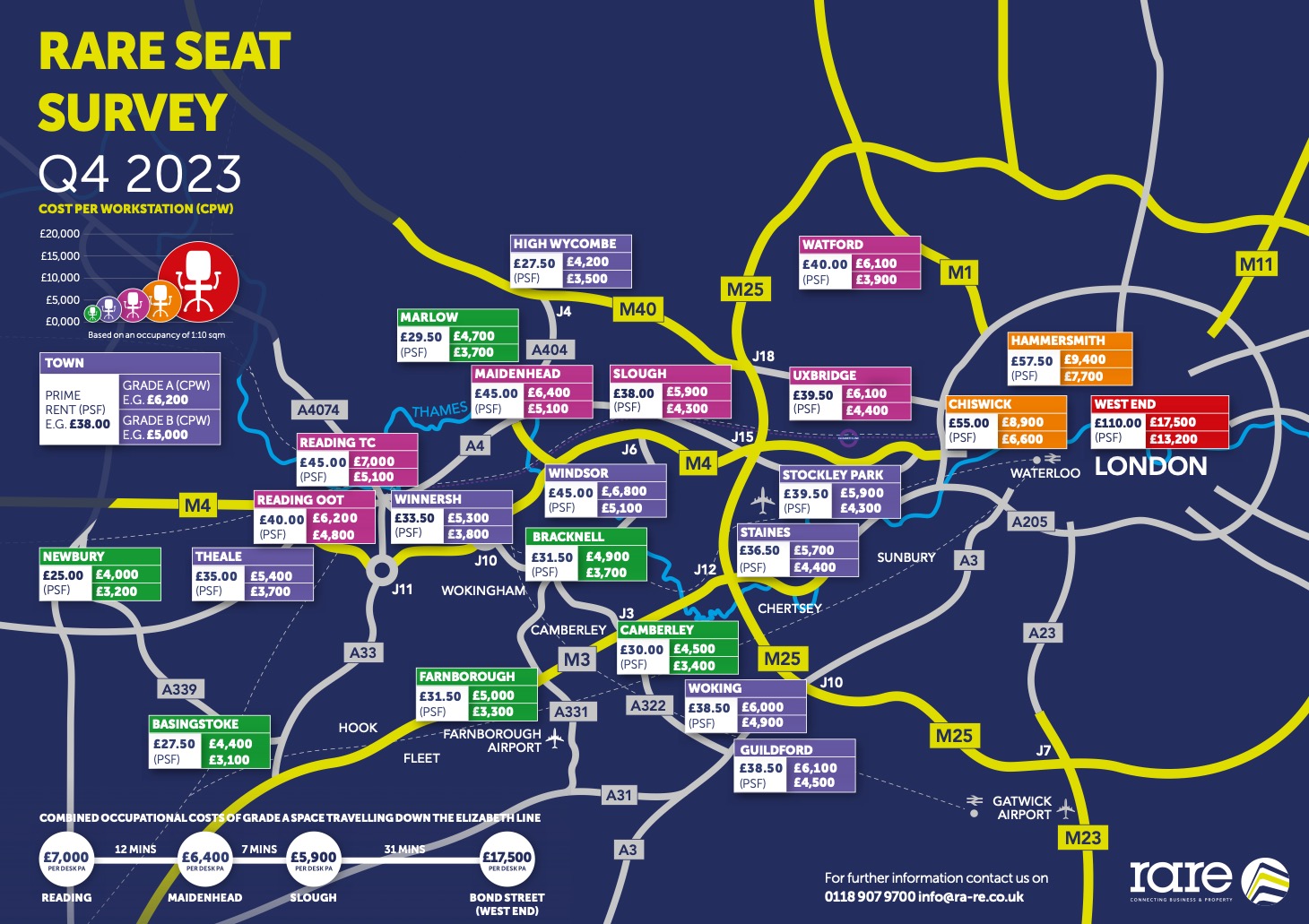

RARE Seat Survey Q4 2023

In the wake of occupiers undergoing significant downsizing, what lies in store for the future of Thames Valley office buildings?

In the heart of the Thames Valley, a staggering 16.3 million square feet of office space lies vacant, beckoning for a transformation that sparks innovation and addresses the evolving needs of our communities.

As a property consultant who has worked in the Thames Valley for over 35 years, my view is that we urgently need to address what the future of underutilised office buildings should be.

Many believe that just “tarting them up” and securing an array of environmental certifications is all that is necessary but they miss the fundamental point.

Demand for these buildings has significantly diminished and although they may look better than they once did, the fact that many remain largely empty is proof that demand for them has evaporated and another use for the building or the land it occupies is now required.

Notable empty buildings in the Thames Valley include 130,000 sq ft Aldermaston Park, set in 139 acres and decaying, while many in Bracknell have already been converted to residential to varying levels of sucess. Wood Group’s expected move from Shinfield Park to 120,000 sq ft at Green Park represents a 50 per cent downsizing – a typical scenario.

Yes, some office buildings may lend themselves to conversion to residential but who really wants to live in a building that was designed solely as an office? There are some horrendous examples of cheap conversions and I pity those who have to live there. No wonder so many in society these days are suffering mental health issues.

If we are serious about the need to consider the environmental impact of constructing any building, the property industry needs to face facts and start delivering buildings that allow a variety of uses should the original purpose become time expired. If it doesn’t, we leave a legacy of empty, deteriorating hulks of space and create towns that appear as though someone has pulled the plug out of them.

Once again, it highlights that property is trying to satisfy two increasingly opposing aims; an investment vehicle and a “home” for a business. Whilst for many years the two have been aligned, in the post pandemic world the two are diverging at an increasing rate.

Gone are the long leases that once offered security of income. Gone are the requirements from corporates for substantial headquarters together with an insatiable appetite for more space.

We are now faced with occupiers seeking to significantly down size and take space on increasingly flexible terms. The model that served the industry for so long is broken and we urgently need to find another solution.

We have the answer. Contact us to find out more